Founder Desk

From Compliance Control to Continuous Assurance

From Compliance Control to Continuous Assurance

Why Proactive Compliance Is Becoming a Leadership Advantage

After every regulatory inspection, one pattern quietly repeats itself.

Institutions rarely struggle to explain compliance.

They struggle to demonstrate assurance.

This distinction is subtle — but decisive.

In an environment of intensifying regulatory scrutiny, control alone is no longer enough. What regulators, Boards, and increasingly CXOs themselves seek is continuous assurance — the confidence that compliance is not episodic, but sustained.

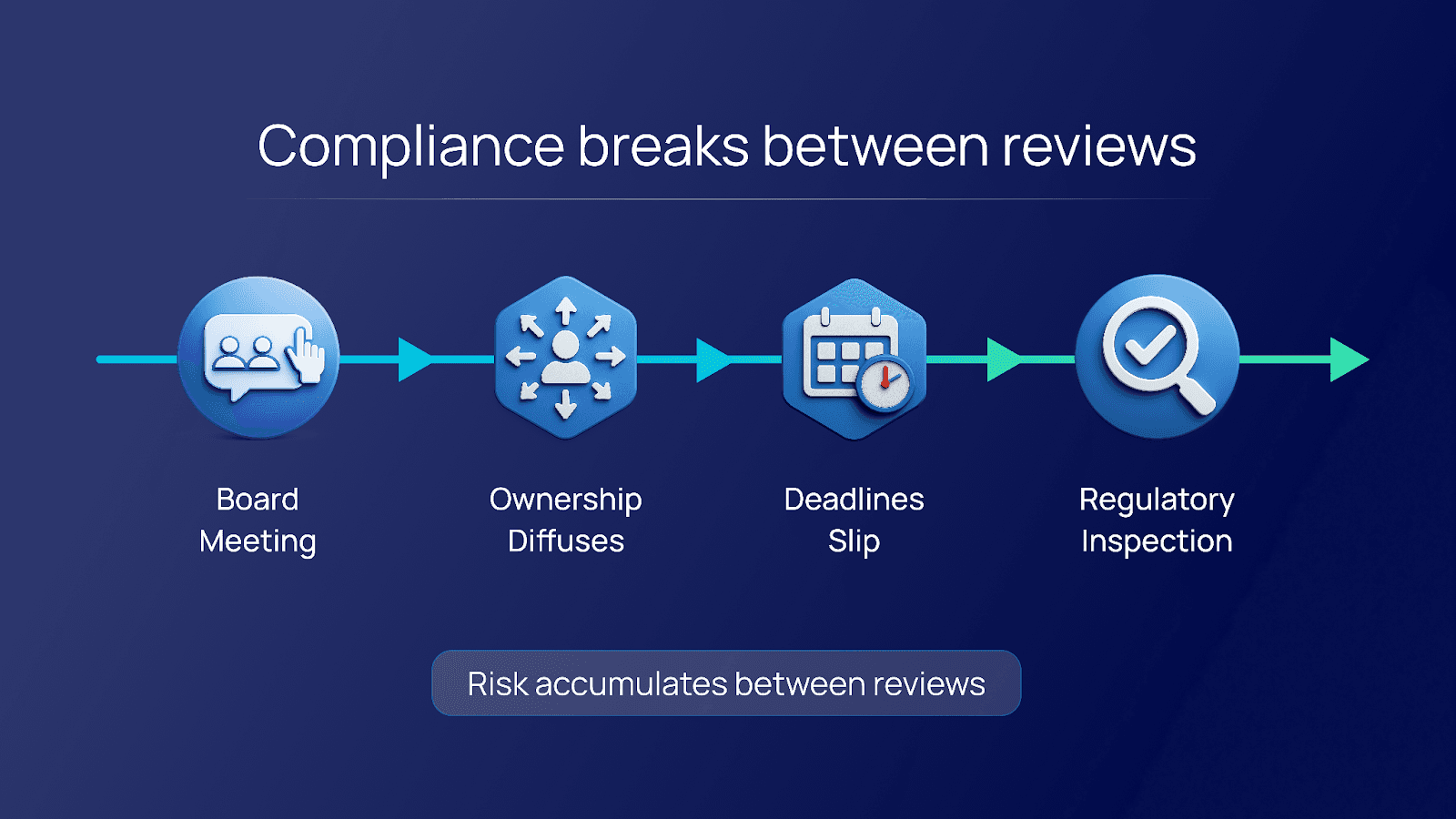

Why Compliance Breaks Between Reviews

Most organisations are well prepared for moments:

Board meetings

Internal audits

Regulatory inspections

But compliance risk rarely materialises in these moments.

It accumulates between them.

Deadlines slip quietly. Ownership diffuses. Controls weaken gradually. Evidence trails fall behind execution. By the time issues surface, they are already findings.

This is why compliance often feels manageable — until it suddenly isn’t.

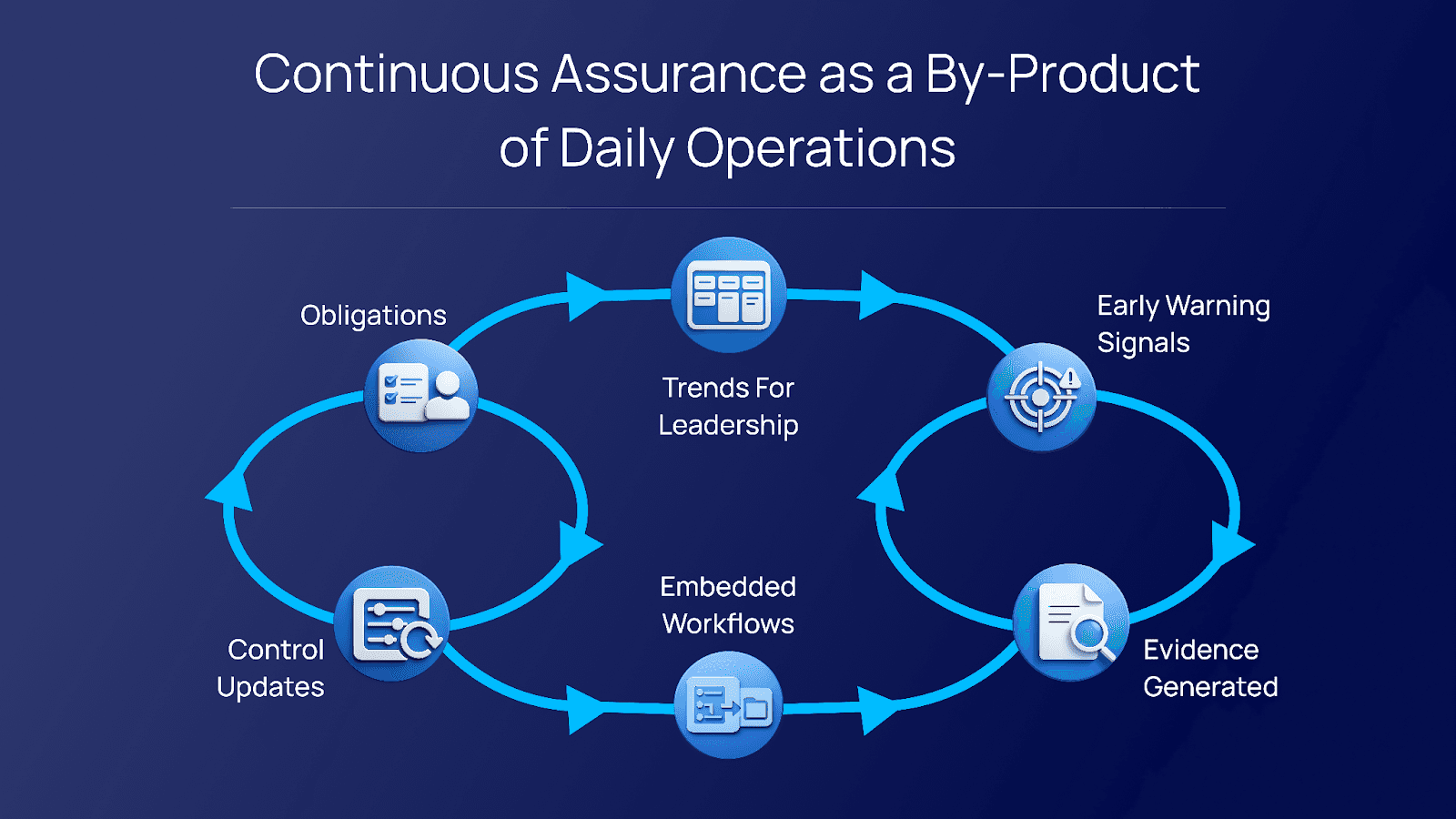

Continuous Assurance: What Changes?

Continuous assurance does not mean constant audits or excessive controls. It means designing compliance so that assurance is a by-product of daily operations, not a last-minute exercise.

At a practical level, this requires:

Regulatory obligations clearly translated into owned, actionable tasks

Compliance embedded into workflows, not appended at the end

Early-warning signals when obligations drift or controls weaken

Evidence generated as work happens — not reconstructed later

Management and Boards seeing trends, not just statuses

In such a model, assurance is always on.

Proactive Compliance Is Not Over-Engineering

A common concern CXOs voice is whether proactive compliance creates friction or slows the business.

In practice, the opposite is true.

Organisations that invest in proactive compliance experience:

Fewer surprises during inspections

Shorter regulatory interactions

More focused Board discussions

Lower compliance fatigue across teams

Greater trust with supervisors

Most importantly, leadership regains strategic bandwidth — time otherwise lost in firefighting, explanations, and remediation.

Compliance as a Leadership Capability

This is where compliance quietly shifts from being a regulatory obligation to a leadership capability.

When compliance is proactive:

Decisions are taken with regulatory foresight

Risks are addressed before they crystallise

Accountability is clear, not retrospective

Confidence replaces anxiety — at every level

Over time, regulators recognise this maturity. Supervisory posture softens. Conversations become constructive. Trust compounds.

Final Thought

Reactive compliance helps organisations survive reviews.

Proactive, continuously assured compliance helps organisations earn credibility.

For CXOs, the question worth reflecting on is:

Are we preparing for the next inspection — or building assurance that lasts beyond it?

Does proactive compliance feel like added effort — or strategic freedom in your organisation?