Founder Desk

Compliance ‘Visibility’ Is Not ‘Control’: Regulators Know the Difference

In many boardrooms today, compliance looks well managed.

Dashboards show green indicators. Reports confirm closures. Committees meet on schedule. On paper, everything feels reassuring.

But when regulators arrive, the tone often changes.

Because visibility is not control. Regulators understand that difference far better than most organisations.

Let me start with a few uncomfortable questions:

If a regulator walked in today, could you demonstrate control, or would you only present reports?

Are your dashboards reflecting real-time compliance, or summarising last month’s status?

When something slips, do you detect it early, or explain it later?

The comfort (and risk) of compliance visibility

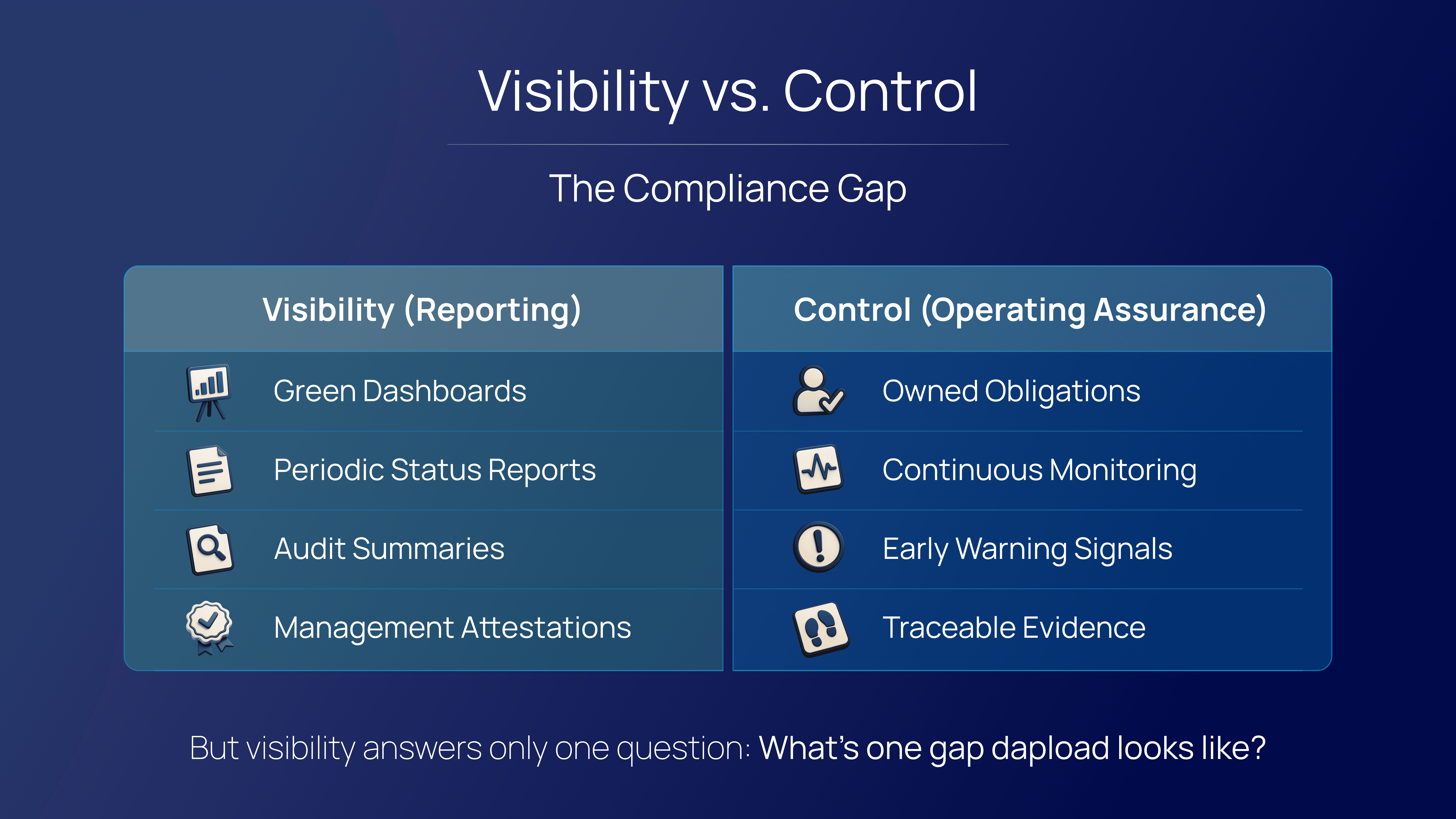

Most institutions have invested heavily in compliance management:

Periodic compliance status reports

RAG-based dashboards

Audit closure summaries

Management attestations

These provide visibility. They are necessary, and they are useful.

But visibility answers only one question:

“What do we believe our compliance status is right now?”

Regulators are asking a tougher question:

“Is the organisation demonstrably in control, continuously?”

What regulators mean by “control”

During inspections, regulators typically probe beyond dashboards:

Who owns each regulatory obligation, explicitly and individually?

How is compliance monitored between reporting cycles?

What signals alert management before a breach occurs?

Can evidence be traced back to a specific regulation and a specific action?

Was the issue prevented, detected early, or discovered after the fact?

These questions are not about reporting discipline.

They are about the organisation’s control architecture.

A subtle but critical distinction: Compliance MS vs Compliance OS

This is the distinction I see many organisations miss.

A Compliance Management System (MS) focuses on:

Tracking activities

Managing checklists

Producing reports

Supporting audits

A Compliance Operating System (OS), by contrast:

Embeds compliance into day-to-day operations

Translates regulations into live, owned obligations

Creates evidence as part of execution

Enables early warning, not post-mortems

Supports continuous, defensible assurance

In simple terms:

A Compliance MS helps you manage compliance.

A Compliance OS helps you run the organisation compliantly.

Regulators can tell the difference.

Why dashboards alone often fail CXOs

Here is a candid observation that many senior leaders quietly acknowledge:

Most dashboards are visual summaries of fragmented processes.

Dashboards show outcomes, not resilience.

They reflect status, not preparedness.

This is why institutions with “green” dashboards still face regulatory findings. It is also why explanations, even when genuine, often fall short.

Proactive compliance: cost or strategic advantage?

This raises a final question, and it is worth asking honestly:

Is proactive compliance merely a defensive cost, or a leadership advantage?

Organisations that invest in proactive, system-led compliance typically see:

Fewer regulatory surprises

Greater confidence during inspections

More informed board oversight

Reduced firefighting and compliance fatigue

Stronger regulatory trust over time

In an environment where regulatory risk is leadership risk, proactive compliance is not over-engineering. It is strategic foresight.

Final thought (and an invitation)

Compliance visibility can reassure management.

Compliance control protects leadership.

The real question for CXOs is this:

Are we confident because we see reports, or because we know the organisation is in control?

I would genuinely value diverse perspectives here, including dissenting ones.