Founder Desk

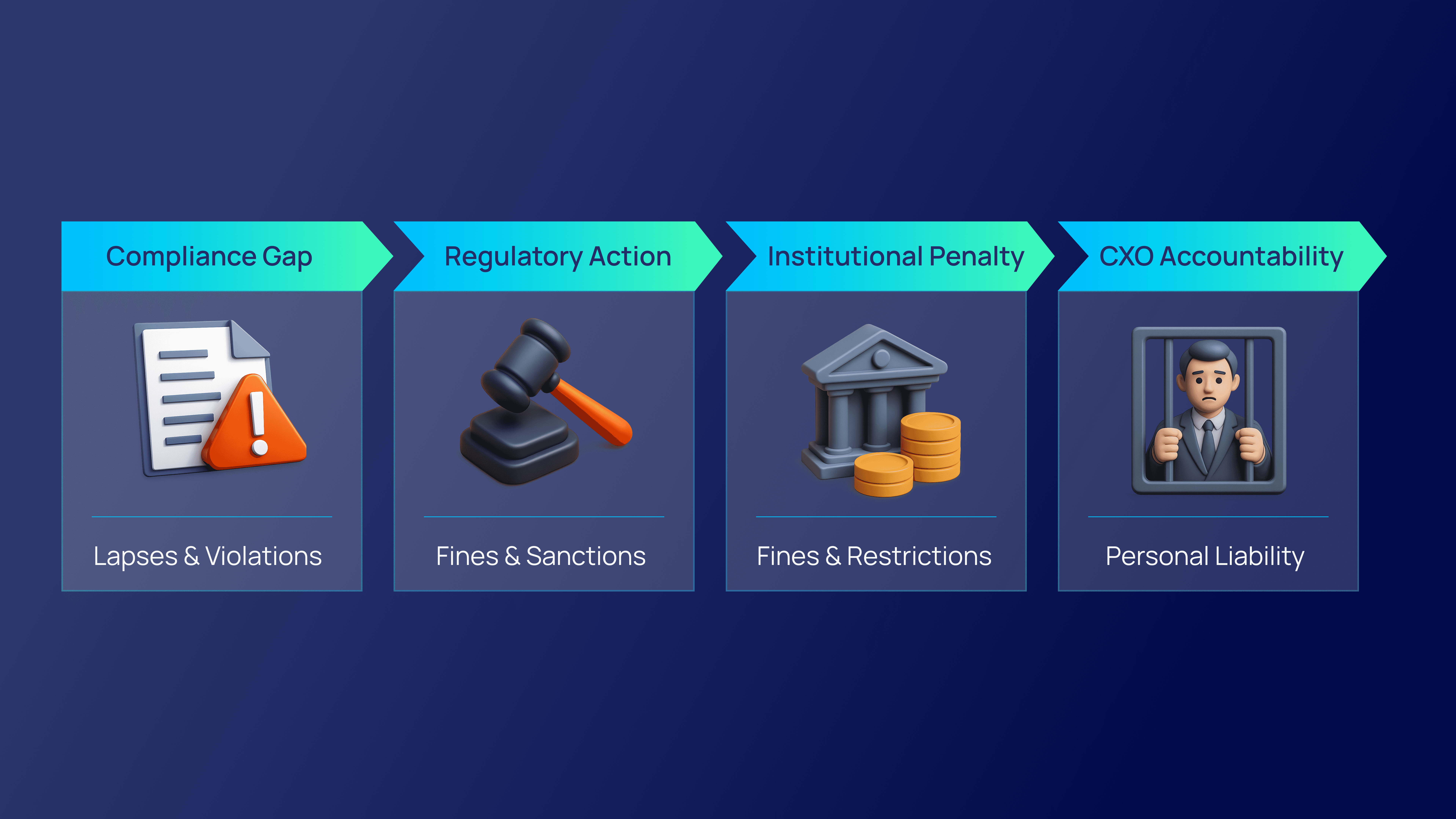

When Compliance Fails, CXOs Pay the Price

Across regulated industries, a hard truth is becoming impossible to ignore:

When compliance fails, accountability no longer stops at the institution, it lands squarely on the CXO.

Regulators today are faster, more forensic, and far less forgiving. Monetary penalties, supervisory restrictions, public disclosures, and even personal accountability for senior leadership are no longer rare events. They are becoming standard enforcement tools.

Yet inside many organisations, compliance is still managed using fragmented systems, spreadsheets, and retrospective reporting, approaches that are increasingly misaligned with today’s regulatory expectations.

This disconnect is no longer sustainable.

The Real Compliance Risk Isn’t Intent; It’s Architecture

Most compliance failures are not driven by negligence or lack of expertise. They stem from how compliance is organised and operationalised.

Across institutions, the same structural issues repeat:

Regulations arrive continuously from multiple regulators and jurisdictions

Interpretation is manual, inconsistent, and difficult to scale

Obligations are fragmented across departments with diffused ownership

Evidence is assembled after the fact, not generated in real time

Dashboards show status, but not emerging risk

Accountability is operationally distributed, yet personally concentrated at the top

The result is a dangerous asymmetry.

CXOs are held personally accountable for outcomes produced by systems never designed to function as an integrated risk management platform in a high-velocity regulatory environment.

Why Traditional Fixes No Longer Work

The default response to regulatory pressure is predictable:

hire more compliance staff, increase audits, add review committees, and tighten manual controls.

While necessary, these responses are inherently reactive.

Today’s regulators expect more than periodic assessments. They expect continuous control, early detection, and demonstrable assurance, even as regulatory change accelerates.

The issue is not effort.

It is infrastructure.

This is why many well-intentioned compliance programmes struggle under modern regulatory compliance challenges: they are supported by tools and processes built for a slower, simpler era.

Compliance Has Become an Operating System Problem

Forward-looking organisations are reframing compliance not as a back-office function, but as a core enterprise capability.

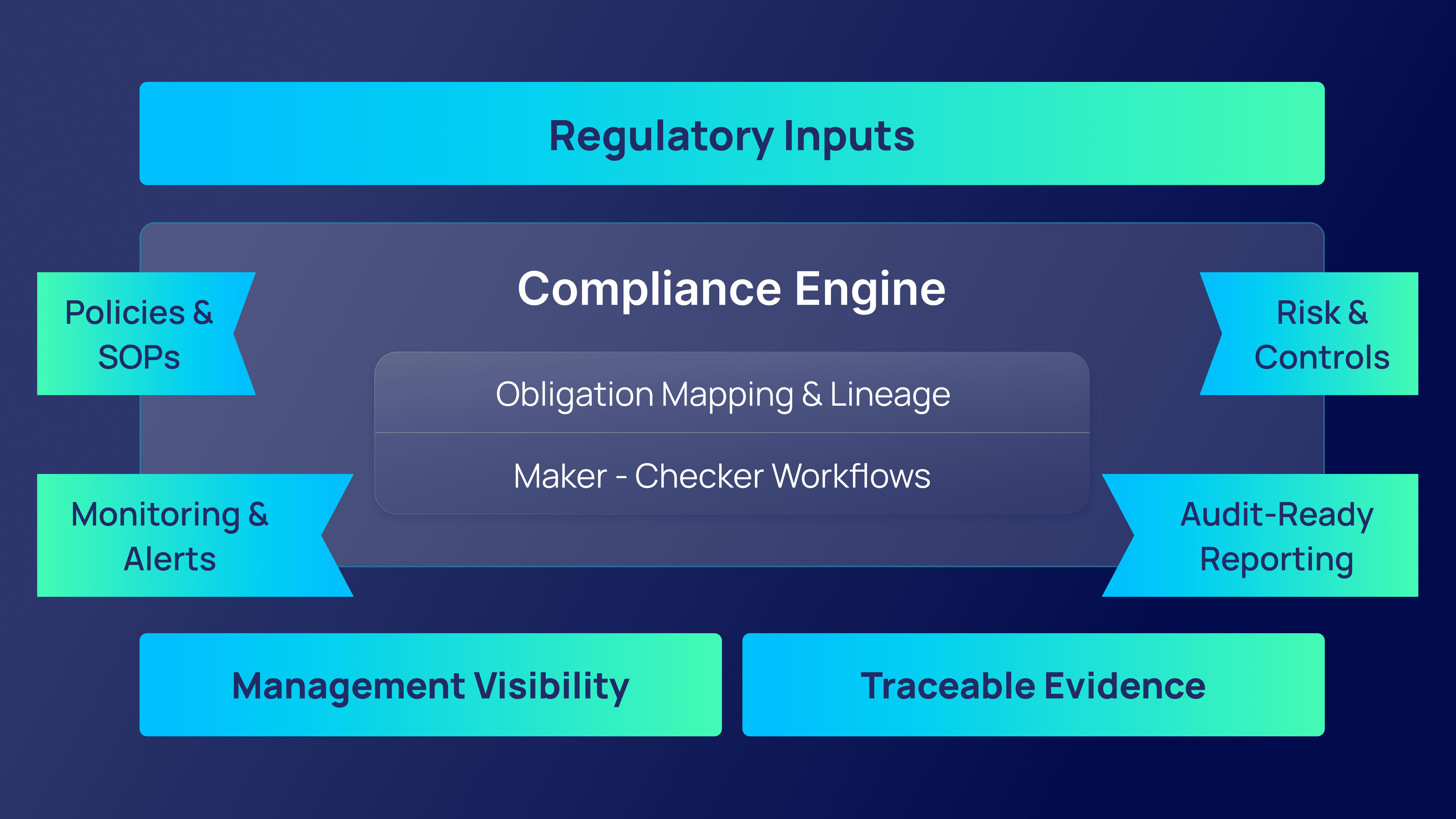

This shift requires more than isolated tools. It requires a regulatory compliance management solution that functions as a foundational layer across the organisation.

A modern Compliance Operating System enables institutions to:

Ingest regulations and maintain clear regulatory lineage

Translate regulatory text into actionable, traceable obligations

Embed maker–checker accountability across functions

Link obligations to policies, SOPs, risks, and controls

Support regulatory change monitoring across jurisdictions

Provide management and Boards with continuous visibility

Generate audit-ready compliance evidence by design

In effect, compliance evolves from periodic reporting into continuous compliance automation, embedded into how the organisation operates every day.

From Fragmentation to Integrated Control

In regulated sectors, particularly within governance risk and compliance in banking, the need for integration has become unavoidable.

Institutions are increasingly recognising that compliance, risk, and controls cannot function as separate silos. They must operate as a connected system.

This is where a true integrated risk management platform becomes critical, one that aligns regulatory obligations, operational controls, and accountability within a single, coherent framework.

Without this integration, organisations remain vulnerable to blind spots that only surface when regulators do.

The Strategic Question Has Changed

The question CXOs once asked was:

“Are we compliant as of the last review?”

The question regulators now expect organisations to answer is far more demanding:

“Can you demonstrate, at any point in time, that the organisation is in control?”

This expectation has fundamentally redefined compliance.

Assurances are no longer enough.

Documentation assembled retrospectively is no longer sufficient.

What matters now is real time compliance, supported by systems, data, and traceability.

Compliance Is Now Leadership Risk Insurance

A well-architected regulatory compliance management solution does more than reduce fines or improve audit outcomes.

It reshapes the organisation’s risk posture at the leadership level.

It:

Protects CXOs from personal exposure

Builds supervisory confidence

Strengthens Board-level oversight

Reduces compliance fatigue across teams

Converts compliance from a cost centre into a governance asset

In an environment where regulatory scrutiny continues to intensify, compliance is no longer discretionary. It is strategic infrastructure.

Final Thought

Institutions that succeed under tightening regulatory scrutiny will not be those that simply try harder at compliance.

They will be the ones that design compliance as a system, not a series of after-the-fact activities.

For CXOs, the choice is clear:

Manage compliance reactively or architect it as an integrated, always-on capability.